The aptitude for identifying opportunity within disorder presents a highly valuable skill that can empower individuals to prosper in tumultuous times, particularly in the mercurial stock market. Although seemingly paradoxical, historical evidence suggests that periods of turbulence often beget monumental advancements. Indeed, some of the most distinguished individuals in history have been those who perceived opportunities, where others solely observed chaos and desolation.

Exhibiting Equanimity and Adaptability in the Stock Market

A critical factor in discovering opportunity amid the capricious stock market lies in maintaining composure and clear-headedness. Amidst the widespread panic, it is prudent to remain poised and rationally assess the situation. This approach enables well-informed decisions, facilitating positive advancement even in the face of market turbulence. Additionally, embracing calculated risks and venturing beyond one’s comfort zone is essential for capitalizing on available opportunities.

Another salient consideration is adaptability in the face of stock market fluctuations. Rapid acclimatization grants a distinct advantage amidst uncertainty and perpetual change. Instead of resisting alterations, individuals should be amenable to new experiences, requiring a cognitive shift and relinquishing entrenched habits and thought patterns. This adaptability is indispensable for achieving success amidst volatility.

Transforming Adversity into Opportunity in the Stock Market

The most accomplished investors throughout history have successfully transmuted adversity into opportunity, utilizing challenges as catalysts for success. Emulating their example by remaining composed, and adaptable, and seizing opportunities in the volatile stock market is a viable strategy.

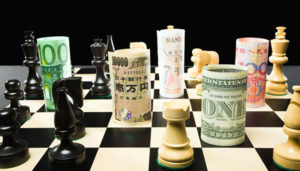

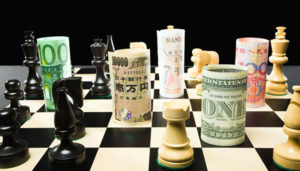

The Efficacy of the Contrarian Strategy in the Stock Market

The Contrarian Strategy, alternatively known as the Overreaction Hypothesis, posits that investors may profit by deviating from collective sentiment.

Conclusion

The Contrarian Strategy, also known as the Overreaction Hypothesis, emphasizes that investors can profit by going against the crowd, aligning with the principles of Volatility Trading Strategies. These strategies capitalize on market fluctuations and extreme sentiments to identify investment opportunities. Mastering the art of recognizing opportunities amidst market volatility and chaos is a crucial skill that enables investors to flourish during challenging times. By maintaining equanimity, exhibiting adaptability, and incorporating the Contrarian Strategy into their investment approach, investors can harness market volatility to yield higher long-term returns.

Mass Psychology plays a significant role in market volatility, with collective panic and elevated fear levels driving markets to become increasingly volatile. By combining an understanding of Mass Psychology with market volatility, investors can seize opportunities at favorable prices and capitalize on prospects that others might disregard.

Numerous successful investors have employed this approach, purchasing when others are divesting and liquidating when others are acquiring. By deviating from the consensus, these investors have consistently generated substantial returns over extended periods.

Ultimately, embracing chaos and volatility as opportunities for growth rather than obstacles is key to thriving in the capricious stock market. By fostering mental resilience, adaptability, and strategic thinking, investors can transform adversity into a springboard for success, positioning themselves advantageously in the ever-evolving financial landscape.

Other Articles of Interest

Understanding Housing Alerts and Real Estate Market Cycles Housing alerts are notifications or signals that indicate significant changes in the ...

I understand your request. I'll update and revise the essay on overcoming overconfidence bias, incorporating current data, concepts of mass ...

The Temporal Tapestry: Unraveling Present Bias Psychology in Modern Investment Decisions Present bias psychology, a cognitive tendency that leads individuals ...

Welcome to the comprehensive guide to achieving financial prosperity in your 30s! This pivotal decade presents a unique opportunity to ...

Introduction In the realm of investments, where conformity is the norm, a distinct breed of investors known as contrarians emerges ...

Unveiling the Enigma: "Who Said Buy When There's Blood in the Streets" In the realm of financial ventures, a renowned ...

This article delves into a comprehensive analysis of the Japanese Yen ETF, highlighting its advantages, risks, and market performance. The ...

The Dow Jones Utility Average (DJUA) functions as a crucial stock market index, monitoring the performance of 15 utility companies ...

Perception plays a crucial role in how we interpret information and the data we are exposed to shapes our perception ...

Child hunger is an alarming global issue that continues to worsen at an unprecedented rate, with millions of children suffering ...

The aptitude for identifying opportunity within disorder presents a highly valuable skill that can empower individuals to prosper in tumultuous ...

Investing in the stock market can be a game of patience and perseverance, often likened to a war of attrition ...

One of the key factors contributing to the crowd's losses in the stock market is the influence of emotions. A ...

What should traders have learned from the Nov-Dec 2018 crash? There is only one answer really; fear pays poorly. ...

Fiat Money The Root Of All Things Bad Fiat Money: The mother of all evils is fiat. Without Fiat, none ...

Business Investment; the best time to buy is when the crowd is scared Business investing: One of the best places ...

The monthly chart of the Dow going from 1985 Stock market bull vs bear: Each point on this chart represents ...

What is the difference between a Market correction and a back-breaking correction? A sharp stock market correction is the thing ...

Denmark has joined several other European countries in banning garments that cover the face, including Islamic veils such as the ...

STOCKHOLM (Reuters) - Sweden's top three parties are running almost level four months ahead of a general election, with the ...

The Journal, citing unnamed sources, reported that job cuts were likely to extend into 2019.Separately, Bloomberg News reported the bank ...

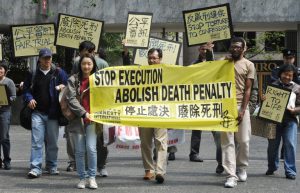

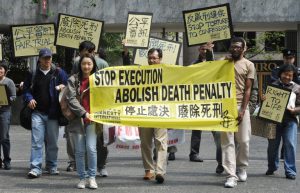

Chinese convicts executed after stadium trial Beijing (AFP) - Thousands of spectators filled a stadium in China to watch 10 ...

Have Too Many Employees, Branches Japanese banks may have too many employees and branches, and the overcapacity is contributing to ...

BOJ can't exit stimulus when inflation below 1 pct - BOJ Gov candidate Ito TOKYO (Reuters) - The Bank of ...

Is Europe Swinging to the Right? Austria went to polls on Oct 15 to choose its next leader. After a ...

For African migrants, 'extreme vetting' from U.S. to Europe slams the door shut The Trump administration's immigration crackdown was only ...

Rise of the machines must be monitored, say global finance regulators LONDON (Reuters) - Replacing bank and insurance workers with ...

Middle-Class Families Confront Soaring Health Insurance Costs CHARLOTTESVILLE, Va. — Consumers here at first did not believe the health insurance ...

Agrihoods: The newest trend in millennial living Millennials are harkening back to simpler days and creating communities on farms, surrounded ...

Over the past several years the Naysayers have predicted the Market would crash and burn; we blatantly disagreed and opted ...

Manufacturing output continues to improve, even though the number of manufacturing jobs in the U.S. continues to decline and this ...

Bearish vs Bullish; outlook for a stock market bull is much stronger Flashback; Dow today looks like Dow yesteryear. The ...

This Bull Market is universally disliked because it's being artificially Propped Throughout this bull-run, a plethora of reasons have been ...

Stock Market Fear and Greed are the primary driving force behind all markets Stock Market Investing is all about not ...

Jesus said, “ Recognize what is in your sight, and that which is hidden from you will become plain to ...

Math Scores dropping precipitously indicating that Americans are becoming Dumber A random study was conducted with 348 young children to ...

Here’s how Central Bankers Rig the Markets Central Banks Stock Market: Central bankers utilise fiat money to rain misery and ...

Wells Fargo: A Somerset County woman is suing Wells Fargo Bank alleging she was fired for refusing to participate in ...

South china sea dispute: Beijing is looking for foreign contractors to help find oil and gas under the South China ...

Ant Financial Services, China’s largest online payment operator, sees mobile wallet applications becoming the next big technology trend in the ...

The International Monetary Fund (IMF) says the global economic outlook is "brightening," but warns that "protectionism" and geopolitical tensions could ...

Indoctrination Definition: Are Your Perceptions Really Yours? To understand this topic, what indoctrination means, let’s start with a question. If ...

United Airlines will not fire employees involved in the recent dragging of a passenger from his seat, an incident CEO ...

Mass Hysteria definition: Current Overreaction Is The Perfect Example According to Wikipedia, the definition of Mass Hysteria is In sociology ...

What is quantitative easing? We are entering a new paradigm; get used to forever Quantitative Easing - QE, though it ...

The Boom and Bust Cycle: Opportunity Knocking? Remember that when the markets eventually correct, this correction will be broadcasted as ...