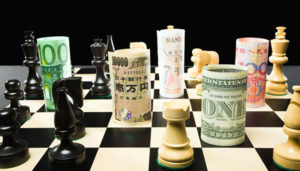

This article delves into a comprehensive analysis of the Japanese Yen ETF, highlighting its advantages, risks, and market performance. The Japanese Yen ETF is an exchange-traded fund that tracks the Japanese yen’s value against other currencies, offering investors a convenient means to broaden their portfolios and safeguard against currency risk.

This financial instrument allows investors to gain exposure to the Japanese yen without directly trading it, making it an essential investment tool. Its history dates back to 2006 when WisdomTree Investments launched the first Japanese Yen ETF, and since then, various providers have introduced a range of Yen ETFs with different investment objectives and strategies, gaining popularity among investors seeking yen exposure.

In this thorough analysis, we aim to provide readers with a profound understanding of the Japanese Yen ETF’s potential role in their investment portfolios, emphasizing the benefits of diversification and protection against currency risk. While investing in Yen ETFs comes with some risks, such as market volatility and liquidity concerns, the potential rewards outweigh these risks, making Yen ETFs a valuable investment alternative. Investors should carefully assess the advantages and risks before making any investment decisions.

What is a Japanese Yen ETF?

A Japanese Yen ETF is an investment fund designed to mirror the Japanese yen’s performance relative to other major currencies like the US dollar, euro, and pound. It achieves this by investing in yen-denominated assets, including stocks, bonds, and currency futures.

The value of the Japanese Yen ETF fluctuates with changes in the yen’s exchange rate. When the yen appreciates against other currencies, the ETF’s value rises, and vice versa. These ETFs offer investors exposure to the Japanese yen without directly trading currency pairs and are traded on stock exchanges. Different types of Japanese Yen ETFs focus on various currency pairs, and they typically have low management fees, offering liquidity and convenience for gaining currency exposure.

How Japanese Yen ETFs Function

- Investing in yen-denominated assets: Japanese Yen ETFs invest in assets like Japanese stocks, bonds, and currency futures denominated in yen. By holding a basket of yen-based assets, the ETF aims to track the yen’s performance.

- Asset performance influences ETF value: The value of the Japanese Yen ETF is tied to the underlying yen-denominated assets’ performance. If these assets increase in value, the ETF’s share price rises, and if they decline, the share price falls. Hence, the ETF seeks to reflect yen returns by investing in yen-denominated assets.

- Exposure to the yen: Investing in the Japanese Yen ETF grants investors exposure to the Japanese yen without directly purchasing yen or yen-denominated assets. The ETF’s value increases with yen appreciation against other currencies and decreases with yen depreciation, enabling investors to profit from yen price movements.

- Management fees apply: Like other ETFs, Japanese Yen ETFs charge management fees for operating the fund, covering expenses such as trading the underlying assets, administration, and marketing. Investors need to consider these fees while evaluating different Japanese Yen ETF options.

- Tradable like stocks: Japanese Yen ETFs are listed on stock exchanges, allowing easy buying and selling during trading, much like stocks. Investors can use market orders, limit orders, and other trading strategies to invest in Japanese Yen ETFs. Liquidity enables swift entry and exit from positions.

To sum up, Japanese Yen ETFs aim to provide investors exposure to the Japanese yen by investing in yen-denominated assets. By tracking the yen’s performance, the ETF facilitates profiting from yen price movements without directly trading the currency. Tradable like stocks, Japanese Yen ETFs offer investors convenience and liquidity.

Types of Japanese Yen ETFs

Japanese Yen ETFs come in various types, each with unique characteristics. Some track the yen’s performance against the US dollar, the world’s most widely traded currency, while others follow its performance against the euro, the second most widely traded currency. Additionally, Japanese Yen ETFs track the yen’s performance against other major currencies like the British pound, Swiss franc, and Australian dollar.

Advantages of Investing in Japanese Yen ETFs

- Diversification: Japanese Yen ETFs provide exposure to the Japanese yen, diversifying an investment portfolio heavily weighted towards US dollar assets. This diversification reduces risk and volatility.

- Currency risk hedge: Investing in Japanese Yen ETFs can hedge against currency risk for investors with exposure to Japanese stocks or bonds. Yen appreciation can offset losses from declining Japanese stock prices, reducing overall currency risk.

- Potential for higher returns: Japanese Yen ETFs can generate substantial returns if the yen appreciates significantly against other major currencies like the US dollar. While currency movements are challenging to predict, a strengthening yen can lead to robust ETF gains.

- Convenience and liquidity: Japanese Yen ETFs offer a convenient means to gain exposure to the Japanese yen without directly trading currency pairs or yen-denominated assets. Tradable on stock exchanges, they provide liquidity and flexibility for investors.

- Low costs: Japanese Yen ETFs have low management fees, as they are passively managed funds that track yen performance. Their affordability makes them an appealing option for gaining currency exposure.

- Transparency: Japanese Yen ETFs regularly disclose their holdings, enabling investors to understand the assets the ETF invests in to achieve its investment objective. Transparency clarifies ETF operations and return generation.

To conclude, the primary advantages of Japanese Yen ETFs are diversification benefits, currency risk hedging, potential for higher returns, convenience, low costs, and transparency. For investors seeking exposure to the Japanese yen, Japanese Yen ETFs present an attractive option to consider.

FAQs

Q: What is a Japanese Yen ETF? A: A Japanese Yen ETF is an exchange-traded fund that tracks the performance of the Japanese yen against other currencies, providing investors exposure to the yen’s value without trading it directly.

Q: How does a Japanese Yen ETF work? A: Japanese Yen ETFs invest in yen-denominated assets like stocks, bonds, and currency futures, aiming to mirror the yen’s performance. When the yen appreciates, the ETF’s value rises, and vice versa.

Q: Why invest in a Japanese Yen ETF? A: Investing in a Japanese Yen ETF offers diversification, a hedge against currency risk, potential for higher returns, convenience, low costs, and transparency.

Q: What are the advantages of a Japanese Yen ETF? A: The advantages include exposure to the Japanese yen, reduced risk and volatility through diversification, protection against currency risk, potential gains from yen appreciation, convenience, and affordability.

Q: How can I trade a Japanese Yen ETF? A: Japanese Yen ETFs are listed on stock exchanges and can be easily bought and sold like stocks, providing liquidity and flexibility for investors.

Q: Are there different types of Japanese Yen ETFs? A: Yes, Japanese Yen ETFs come in various types, tracking the yen’s performance against different major currencies like the US dollar, euro, pound, etc.

Q: What is the history of Japanese Yen ETFs? A: The first Japanese Yen ETF was launched in 2006 by WisdomTree Investments, and since then, several providers have introduced different Yen ETFs, gaining popularity among investors.

Q: What are the risks associated with Japanese Yen ETFs? A: Risks include market volatility, liquidity concerns, and uncertainty in currency movements. Investors should carefully assess these risks before making investment decisions.

Q: How can a Japanese Yen ETF diversify my portfolio? A: By providing exposure to the Japanese yen, a Yen ETF diversifies a portfolio primarily dominated by US dollar assets, reducing overall risk.

Q: Is a Japanese Yen ETF a good hedge against currency risk? A: Yes, investing in a Yen ETF can hedge against currency risk for investors with exposure to Japanese stocks or bonds, offsetting losses from declining Japanese stock prices.

Q: What role can a Japanese Yen ETF play in my investment strategy? A: A Japanese Yen ETF can offer portfolio diversification, a hedge against currency risk, and the potential for higher returns, depending on an investor’s specific investment objectives.

Q: How can I evaluate the performance of a Japanese Yen ETF? A: Investors can track the ETF’s performance by comparing its value with the yen’s exchange rate against other major currencies. Regularly reviewing the ETF’s holdings and analyzing its historical returns can also provide insights.

Q: Are Japanese Yen ETFs suitable for long-term investors? A: Yes, Japanese Yen ETFs can be suitable for long-term investors seeking to diversify their portfolios, hedge against currency risk, and potentially benefit from yen appreciation over time.

Q: What should I consider before investing in a Japanese Yen ETF? A: It is essential to carefully evaluate the advantages, risks, and costs associated with Japanese Yen ETFs, considering individual investment goals and risk tolerance before making any decisions.