Understanding Housing Alerts and Real Estate Market Cycles

Housing alerts are notifications or signals that indicate significant changes in the real estate market, such as fluctuations in property prices, changes in interest rates, or shifts in buyer demand. These alerts can serve as valuable tools for investors, helping them make informed decisions based on current conditions. Understanding how these alerts relate to real estate market cycles is crucial for anyone looking to invest wisely in the housing sector.

Real estate market cycles typically consist of four distinct phases: recovery, expansion, hyper-supply, and recession. Each phase presents unique opportunities and challenges for investors. Recognizing these cycles and the signals that accompany them can enhance an investor’s ability to capitalize on favourable market conditions while mitigating risks during downturns.

The Role of Mass Psychology in Real Estate Investing

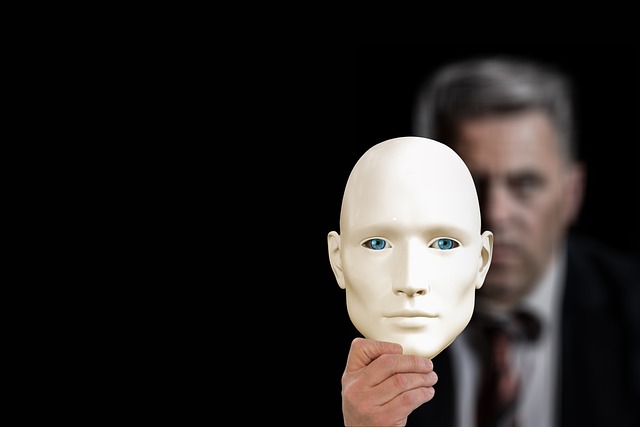

Mass psychology significantly influences the behaviour of investors in the real estate market. The collective sentiment of buyers and sellers can lead to irrational decisions driven by fear, greed, or euphoria. For example, during the expansion phase of a market cycle, optimism can lead to increased buying activity, driving prices higher. Conversely, during a recession, fear can cause panic selling, further depressing prices.

George Soros, a renowned investor, emphasizes that market trends often reflect the psychology of participants rather than purely objective factors. He states, “It is not whether you are right or wrong that is important, but how much money you make when you are right and how much you lose when you are wrong.” This statement highlights the impact of emotional decision-making on investment outcomes, particularly in real estate, where market sentiment can shift rapidly.

Cognitive Biases Affecting Real Estate Investors

Cognitive biases can distort an investor’s judgment and lead to poor decisions in real estate. One prevalent bias is the anchoring bias, where investors give too much weight to initial information, such as previous home prices. For instance, if a homeowner bought a property at a high price during a market peak, they might refuse to sell it for less, even when market conditions have changed. This refusal can lead to missed opportunities as they hold onto an asset that may not regain its former value.

Warren Buffett often advises investors to remain rational and avoid emotional attachments to their investments. He suggests that a disciplined approach, grounded in factual analysis, can help mitigate the effects of cognitive biases. By focusing on data and market alerts, investors can make more informed decisions, especially when navigating the various phases of real estate market cycles.

Technical Analysis in Real Estate Investing

Technical analysis involves studying historical price movements and trends to forecast future price behaviour. In real estate, this can include analyzing housing price trends, rental yields, and vacancy rates. Investors who understand these technical indicators can better anticipate shifts in market cycles.

William O’Neil, the founder of Investor’s Business Daily, pioneered techniques that have been successfully applied in stock and real estate investing. His CAN SLIM strategy emphasizes the importance of understanding price patterns and market trends. For real estate investors, this means recognizing when prices are likely to rise or fall based on past performance and current market alerts.

Examples of Housing Alerts Impacting Market Cycles

One clear example of housing alerts influencing market cycles is the 2008 financial crisis. Leading up to the crisis, numerous alerts indicated increasing levels of mortgage delinquencies and declining home values. However, many investors ignored these signals, caught up in the prevailing optimism surrounding housing prices. When the market collapsed, those who had heeded the alerts and sold their properties or refrained from buying faced far less financial devastation.

On the other hand, the recovery phase that followed the crisis showcased the effectiveness of monitoring housing alerts. As the market began to stabilize in 2012, alerts indicating rising home prices and decreasing inventory motivated savvy investors to enter the market. Those who capitalized on this information experienced significant returns as property values increased in the following years.

Economic Indicators and Market Cycles

Economic indicators play a critical role in shaping real estate market cycles. Factors such as interest rates, unemployment rates, and inflation can significantly impact housing demand and property values. For instance, when interest rates are low, borrowing becomes cheaper, encouraging more people to purchase homes. This increased demand can lead to an expansion phase in the market cycle.

Ray Dalio, founder of Bridgewater Associates, stresses the importance of understanding macroeconomic factors in investment decisions. He advocates for a thorough analysis of economic indicators, as they often provide valuable context for recognizing shifts in market cycles. Investors who pay attention to these economic signals are better equipped to make informed decisions regarding housing alerts and potential investment opportunities.

Long-Term Strategies Versus Short-Term Trading in Real Estate

Investing in real estate often involves a choice between long-term strategies and short-term trading. Long-term investors, such as John Bogle, advocate for a buy-and-hold approach, focusing on properties with strong fundamentals. By holding onto investments through various market cycles, these investors can benefit from appreciation and rental income over time.

On the flip side, short-term investors may seek to capitalize on fluctuations within market cycles. Jim Simons, known for his quantitative trading strategies, has achieved remarkable success by analyzing data patterns. Real estate investors can also apply similar techniques to identify short-term opportunities based on housing alerts and market trends.

The Importance of Diversification in Real Estate Investment

Diversification is a critical strategy for managing risk in real estate investing. Investing in various property types or geographic regions can reduce their exposure to any single market event. This principle is echoed by Peter Lynch, who famously stated, “Know what you own, and know why you own it.” A diversified portfolio can provide stability during market downturns and help investors navigate the cycles more effectively.

Carl Icahn, a well-known activist investor, also emphasizes the importance of diversification. He advises investors to consider various sectors and asset classes, allowing for greater resilience during market fluctuations. By diversifying their investments, individuals can better manage risks associated with real estate market cycles and housing alerts.

Technological Tools for Monitoring Housing Alerts

In today’s digital age, technology plays a significant role in monitoring housing alerts and analyzing real estate market cycles. Numerous online platforms and tools provide real-time data on housing prices, rental rates, and economic indicators. By leveraging these tools, investors can stay informed and respond quickly to market changes.

Jesse Livermore, a legendary trader, once noted the importance of timing in investing. While his strategies were developed in an earlier era, the principle remains relevant. Modern investors can use technology to enhance their timing and decision-making, ensuring they act on housing alerts and market signals promptly.

Conclusion: Navigating Housing Alerts and Real Estate Market Cycles

In conclusion, understanding housing alerts and real estate market cycles is essential for investors seeking to optimize their strategies. By recognizing the impact of mass psychology, cognitive biases, and economic indicators, investors can make informed decisions that align with market conditions. The teachings of renowned experts like Warren Buffett, Benjamin Graham, and George Soros offer valuable guidance for navigating these complexities.

Ultimately, investors can position themselves for success in the real estate market by honing their skills in recognizing housing alerts and understanding market cycles. As conditions continue to change, those who remain informed and disciplined will be best equipped to seize opportunities and achieve long-term financial growth.

Housing alerts real estate market cycles

Beyond the Illusion of Control: How to Overcome Overconfidence Bias in Financial Decision-Making

Beyond Instant Gratification: Understanding Present Bias Psychology in Investing

How to build wealth in your 30s pdf download

Embracing the Contrarian King Persona Mindset

Who Said “Buy When There’s Blood in the Streets”?