What should traders have learned from the Nov-Dec 2018 crash?

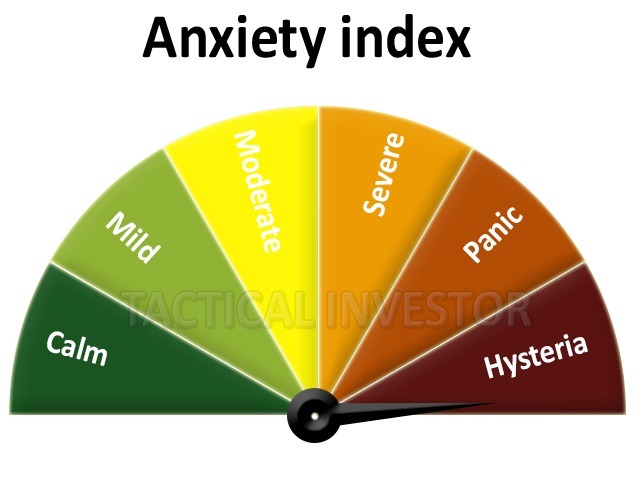

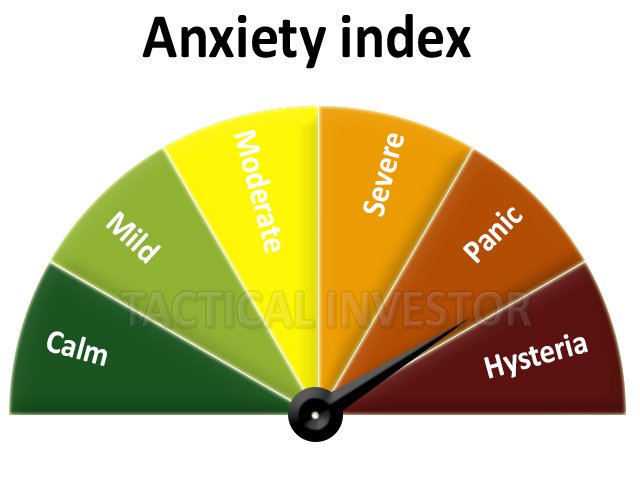

There is only one answer really; fear pays poorly. We sent out an inordinate amount of updates during the crash phase, as we did through every crash like phase the market has experienced over the past several years. The reason we did this, was to prove in real time that giving into fear is a waste of time, money and good health. Once again the so-called crash of 2018 will have to be labelled as the crash that never was.

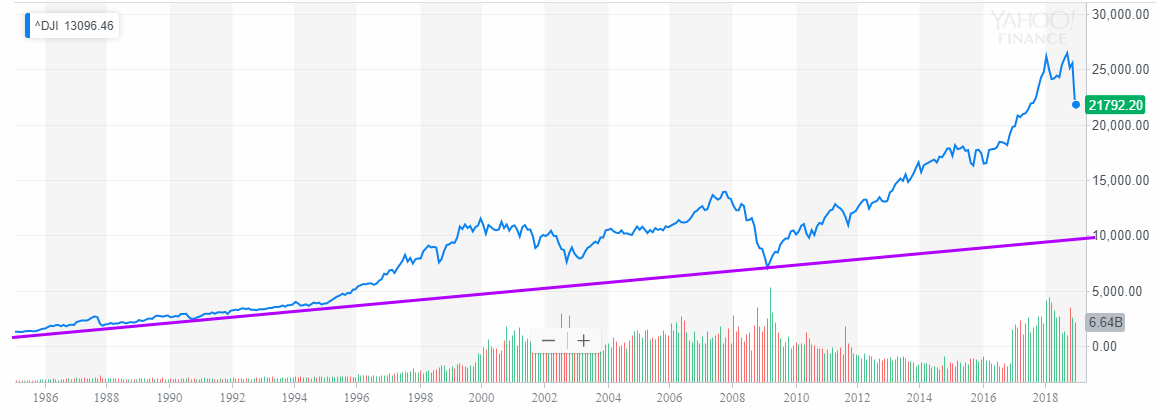

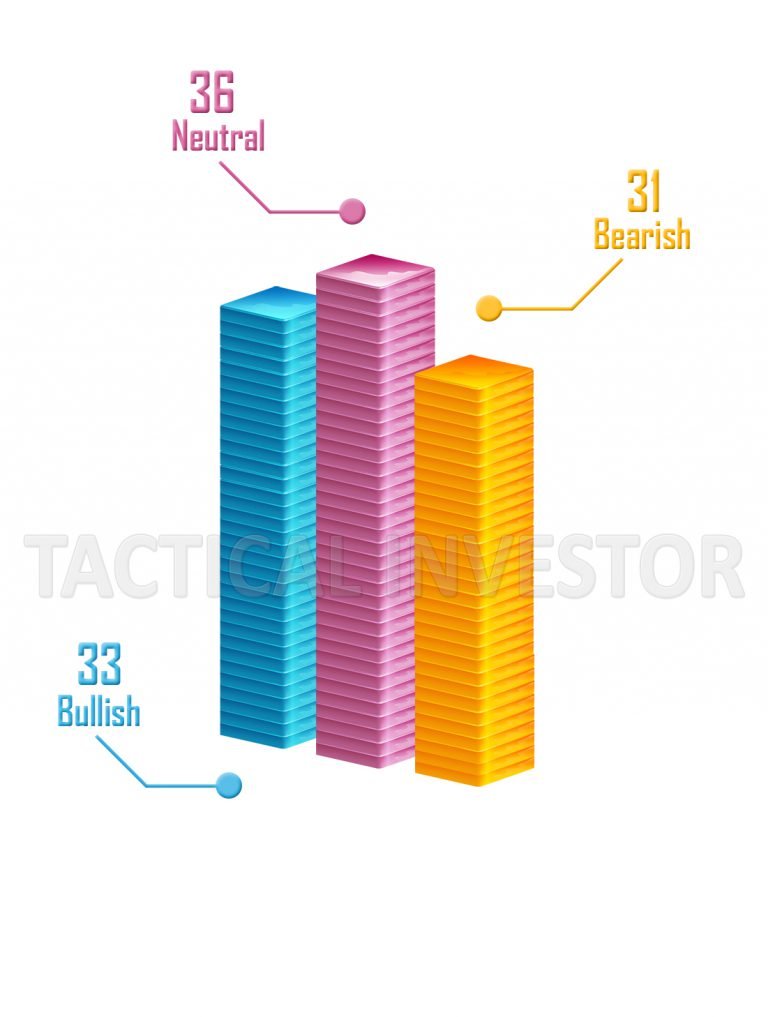

One day the market will experience something that will fall under the “crash” category that all the experts have been warning since the inception of this bull. For that to occur, bullish sentiment will have to soar to the extreme ranges and remain in that zone for an extended period.

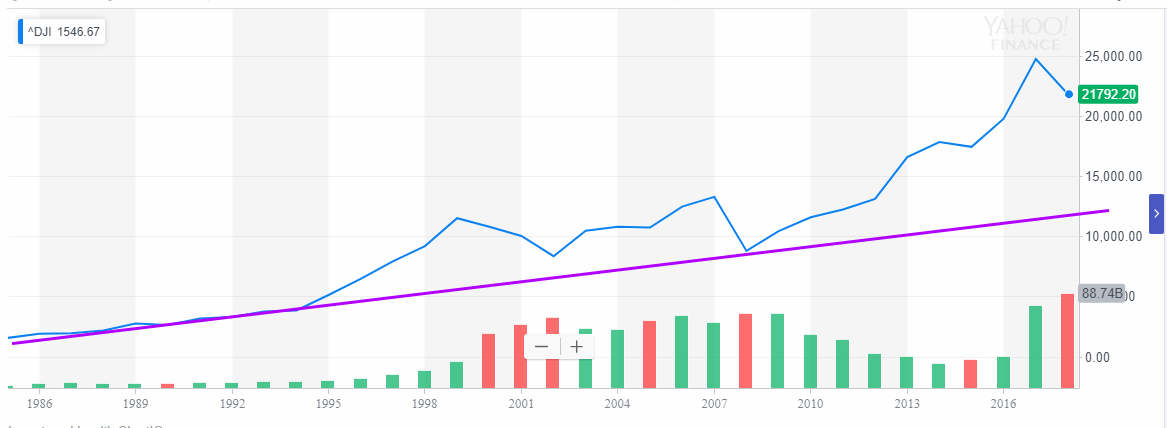

This Stock Market Bull is unlike other bulls

Long before this pullback, we stated that this bull market would soar to heights that would surprise even the most ardent of bulls, and that prediction has mostly come to pass. Some of the most ardent of bulls started to keel over as early as 2016, and the last strong correction virtually knocked all of them out. So where did they err? Over-reliance on old systems; the paradigm has changed, the players have changed, and as a result, the perceptions have changed. When it comes to the markets; the main driving force is emotions (perceptions); everything else on its top day is secondary at best.

Media Lies To The Masses; Trying To Convince Them That Nothing has changed

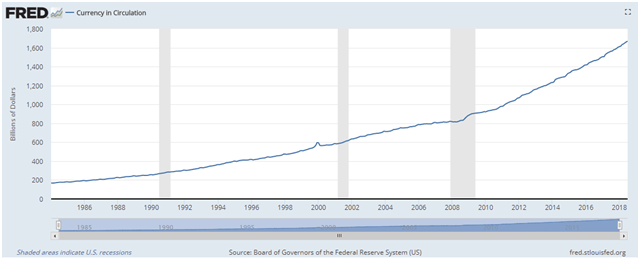

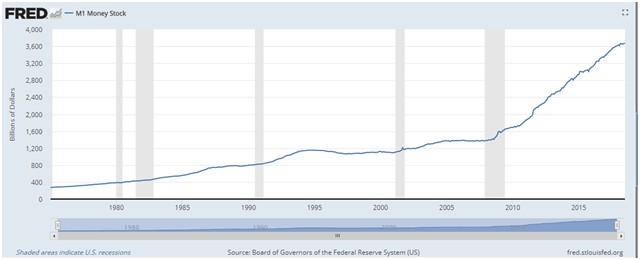

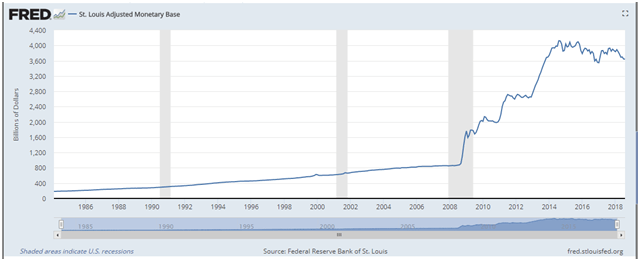

This bull market is unlike any other; before 2009, one could have relied on extensive technical studies to more or less call the top of a market give or take a few months; after 2009, the game plan changed and 99% of these traders/experts failed to factor this into the equation. Technical analysis as a standalone tool would not work as well as did before 2009 and in many cases would lead to a faulty conclusion. Long story short, there are still too many people pessimistic (experts, your average Joes and everything in between) and until they start to embrace this market, most pullbacks ranging from mild to wild will falsely be mistaken for the big one.

The results speak for themselves; the majority of our holdings were in the red during the pullback, but now they are in the black, proving that one should buy when there is blood flowing in the streets. It is a catchy and easy phrase to spit out but very hard to implement, because when push comes to shove, the masses will opt for being shoved.

V readings are still at ultra-high levels

We have alluded to the fact that there is a pattern between extreme weather and market action. Extreme weather usually pushes many people to act in wildly unpredictable ways. Look at animals when there is a sign of impending danger they act strangely, humans are not that different. The only real difference is that humans are not aware of this and tend to blame other factors for this irrational behaviour; this behaviour is reflected in and out of the markets. Violent crimes and or bizarre crimes usually surge during these periods. However, one of the best places to see this type of action is in the markets and the action over the past three months is clear evidence of this.

We have spotted what could turn out to be a new trend between the V-indicator and the Trend Indicator. Our hypothesis:

“Higher (V-Readings) readings, are more likely to ensure that the least probable outcome will come to pass in regards to the markets.”

For example, the least probable outcome from Dec 2018 to Jan 2019 was for the markets to mount a strong rally, but that is precisely what took place. This pattern, if it continues, will provide another level (secondary) of confirmation that this bull market is destined to trend a lot higher than the most ardent of bulls could ever dream of.

Follow the trend for it is your friend, the rest is just hot air and noise

Courtesy of Tactical Investor

Random views on Popular Media Lies

Forget fake news, investors should realize the markets are fake, says asset manager

The global rally in financial markets is unsustainable because it only seems to respond to changes in the real economy when it fits a certain narrative, according to the CIO of investment firm Fasanara Capital.

“I call it fake markets… you know, these days they talk about fake news (but) these are fake markets in a way right?” Francesco Filia, CIO of Fasanara Capital, told CNBC on Wednesday.

Filia argued financial markets had become “complacent” and “insensitive” to fundamental changes in the economy. He suggested while markets appeared to surge higher on so-called good data, a mirrored response lower on negative sentiment had not been evident.

“I think this kind of market environment is both unstable and unsustainable… at some point, something is going to happen that is going to all of a sudden wake up markets as to this overvaluation,” Filia said.

European bourses were trading lower on Wednesday after European Central Bank President Mario Draghi appeared to hint the ECB would be prepared to scale back its monetary policy amid improving economic prospects for Europe.Meanwhile, in the U.S., the broader S&P 500 index posted its biggest one-day drop in about six weeks overnight and closed at its lowest point since the end of May. Wall Street’s losses appeared to accelerate on news that the U.S. Senate had delayed voting on a health care reform bill. Full Story

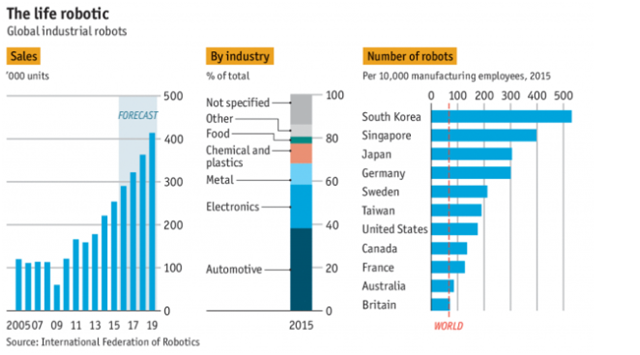

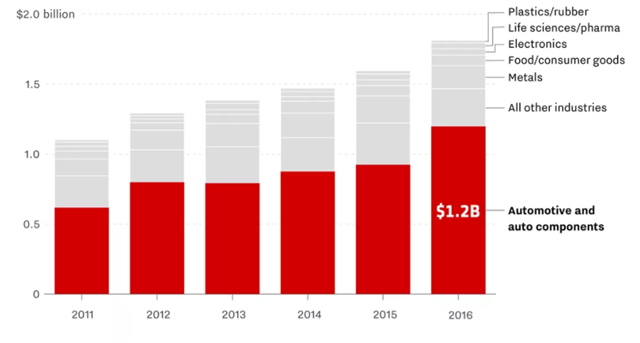

Why robot traders haven’t replaced all the humans at the New York Stock Exchange—yet?

As in so many other industries, robots have been marching into Wall Street for years. That’s especially the case in stock trading, where algorithms now do the majority of buying and selling. Instead of a boisterous trading floor, these days many US equity transactions happen in a data center in suburban New Jersey. One place where human traders are safe, though, is the New York Stock Exchange, which has roots going back two centuries. The stock exchange has made sure its human presence is protected, for now.

NYSE’s several hundred traders and brokers are the face Wall Street, and form a crucial part of the NYSE brand, which is perhaps the best known in the financial industry. The stock exchange packs a marketing punch few, if any, businesses can match. But given that computers dominate stock trading just about everywhere else around the world—and play a pretty big role at NYSE, too—it’s reasonable to ask whether the people milling around the trading floor at 11 Wall Street in Manhattan are worth keeping around. Critics argue that it’s a façade for television cameras, a kind of capitalist Disneyland.

“If you were going to start from scratch, trading would be fully automated,” said Larry Tabb, founder of research and consulting firm Tabb Group. ”That said, I think the human role does provide assistance in trading.” Full Story

Stock Market Fake Risk, Fake Return? Market Crash?

With seemingly everyone from the blogosphere to the Tweeter-in-chief chiming in on fake news, have investors considered their risk/return profile may also be “fake”? When it comes to investing, who or what can we trust, is the market rigged, and why does it matter?

For eight years in a row now, an investment in the S&P 500 has yielded positive returns. In recent years, expressions like “investors buy the dips” and “low volatility” have become associated with this rally.

In the “old days”, investors used to construct portfolios that, at least in theory, provided a risk/return profile that they were comfortable with. For better or worse, I allege those “old days” are over. To be prepared for what’s ahead, let’s debunk some myths.The system is rigged

For those that say the system is rigged, I concur. In my assessment, central banks are largely responsible for a compression of “risk premia.” All else equal, quantitative easing and its variants around the globe have made assets from equities to bonds appear less risky than they are. This is at the very core of central banks efforts to entice investors to take risks, as risk taking is key to making an economy grow. In practice, central banks have foremost pushed up financial assets, but have largely disappointed in generating real investments. As a result, those holding financial assets have disproportionally benefited. Full Story