What is the difference between a Market correction and a back-breaking correction?

A sharp stock market correction is the thing that we encountered in Feb of this current year. The pullback is sharp and quick, and the dread dimensions rise significantly. A backbreaking revision is unique. The term itself is demonstrative of the distinction. The pullback is exceptionally solid however the unpredictability is crazy, and the market seems, by all accounts, to be bipolar. Chaos is by all accounts the request of the day, and even the absolute most impassioned of bulls begin to scrutinize their stance. Every positively trending business sector encounters one such adjustment. Be that as it may, it is difficult to tell ahead of time which redress is going to fall under the extremely difficult category. Trying to figure out which adjustment falls in this class has an exceptionally high open door cost. It is hard to break out of the “uneasiness arrange” in the event that you have been stuck in it for quite a while. These brokers in the long run get their desire of solid adjustment, however they are scared to the point that they can’t act; they keep on expecting that the market will prop up lower and lower.

Advanced warning for market correction

We expressed in July 2017 that the there would be one revision where the Dow would shed 3500-5000 points.

Without a smidgen of uncertainty, we can express that there will be somewhere around one rectification that drives the Dow lower by 3500-5000 points before this positively trending business sector is over. Market refresh June 2, 2017.

Two help focuses become possibly the most important factor. On the off chance that the Dow closes underneath 2400 on a month to month premise, at that point we can anticipate that the pullback should fall nearer towards the 5000 point range. If the Dow closes beneath 23348 on a week by week premise, at that point the above standpoint will likewise hold. 23348 is the low the Dow set in April of this year. Market Update Dec 18, 2018

As the above help calls attention to taken out, we expressed that the following stage was for the market to test the 22,000-23,000 territories. That has happened, the following stage for the market is to step water while gathering up speed to slant higher. This stage will be pressed with unpredictability as the market powers the feeble hands to dump their stocks. Brokers who have experienced this stage before will perceive for it is; an ideal purchasing opportunity occasion.

So do not focus on what happens if the stock market crashes scenario; instead, focus on building a list of stocks you always wanted to own at a lower price. History and Mass psychology both illustrate that permanent stock market bears die broke and that stock market crashes have always proven to be buying opportunities; pull up and long-term chart and try to argue otherwise.

THE STOCK MARKET CORRECTION IS PURPOSELY BEING MADE TO LOOK WORSE THAN IT IS

It looks terrible, the media is siphoning apocalypse type situations, solid bulls are appearing of shortcoming, and even contrarian financial specialists are beginning to break. Unadulterated contrarians are more brilliant than the majority, yet they do have defects; the most brilliant financial specialists are the ones that put the standards of mass brain research into play. They watch the mass mentality, and they comprehend that notwithstanding when dread begins to crawl into the condition, they are constrained to ask this question: Was the group in a condition of rapture when the market beat out? In the event that the appropriate response is “no”, at that point regardless of how horrendous the image may look, the end diversion is that the group is being set up for a bogus descending move. And the ordinary reaction would “why”. Simple answer, this is an advanced form of Pavlovian training.

Take a gander at the above notion information; in the meantime refresh conveyed before today we expressed that bearish slant would come in the 45-47 territories; rather, it remains at 49, which is right around a seven-year high rather than a multi year high. We turned wary in Feb of this current year and put all our plays on hold in light of the fact that bullish assumption took off to a seven-year high; despite the fact that this flood in assessment was transitory, it was sufficient for us to turn mindful. Given the present pattern, the following refresh could drive bearish readings north of 50. This information was gathered up to Saturday of a week ago. At the present time the quantity of people in the bearish and unbiased camps means an astounding 80; this consolidated score nearly coordinates the perusing of the 2008-2009 base. The last time we had such readings was more than 10 years back.

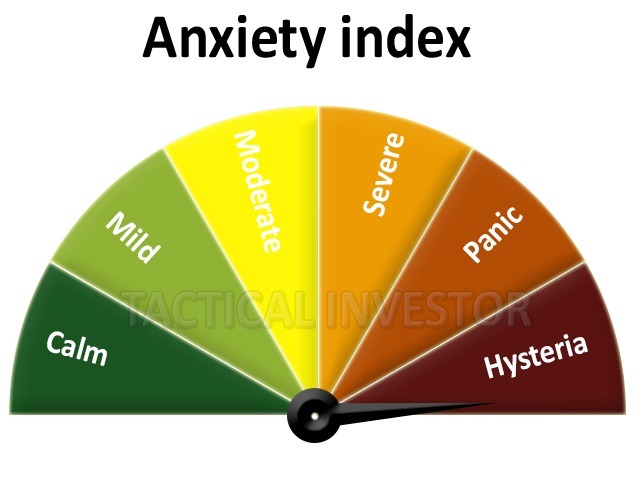

Presently take a gander at the nervousness check, this is the most minimal perusing since the initiation of this measure and given the present pattern it could finish up redlining one week from now; we may even be compelled to broaden the range if the perusing is altogether higher than the current week’s perusing.

Let us look at some other factors

- The S&P 500 is trading 14.3 times below 2019 earnings of $178 per share. However, we if remove the highly overpriced FANG stocks, it is priced roughly 12 times 2019 earnings. The historical average is 16.2

- Value line states that over 100 companies have a forward P/E of 8 or lower; the last time this took place was during the 2008 meltdown but the economy was in shambles at that point, and that is not the case today.

- A lot of fear is being created due to an inverted yield curve; first of all not all inversions lead to recessions, and secondly, there is roughly a two year lag between the inversion and the recession

- Investors are sitting on hoards of cash; this refers to those that were active in the markets. If we include those who have avoided the markets, then one can state that there is a huge group that has missed this entire Bull Run. They will be dragged into this market for the top player’s need many suckers do dump their huge holdings onto.

- The number of “Gloom & Doom” articles is surging, and soon we will have individuals predicting Dow 10,000. Insanity sells; investors were lapping the nonsensical targets of 100K, 200K and the last target of $1 million issued for Bitcoin with straight faces. Very few insane high-level projections have been made for the Dow.

Conclusion

A backbreaking correction is not easy to deal with. In fact, it is hard for everyone to deal with; the only way to get through it is to pull up long-term charts and examine previous corrections. When you look at those charts, try to imagine what the investors felt as the markets pulled back. If you experienced one of these previous corrections remember the thoughts flashing through your mind. One does not have to go back to far; 2008-2009 the markets experienced one of the most brutal of corrections. The master of “Gloom” were projecting Dow 2K during the height of the corrective phase; ten years later, one can clearly see how full of rubbish they were. These same guys are now laying out similar predictions.

The best time to kill a Bull is when it is fat, lazy and arrogant. The current bull is a lean and could turn into a “mean fighting machine” after the recent pullback.

Courtesy of Tactical Investor