Introduction

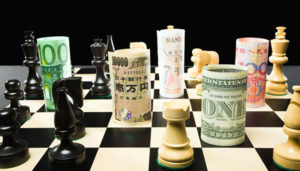

In the realm of investments, where conformity is the norm, a distinct breed of investors known as contrarians emerges. These trailblazers defy conventional wisdom, choosing to swim against the tide. Embodying this unique approach is the contrarian king persona, a believer in the art of investing unconventionally.

While most investors follow market trends and popular sentiment, the contrarian king persona forges a different path. Acknowledging the sway of emotions in the market, he refrains from being influenced by herd mentality and instead evaluates situations critically.

A cornerstone of contrarian king persona’s strategy is buying when others sell and selling when others buy. Amidst market panics and price plunges, he identifies opportunities to acquire undervalued assets, enabling him to gain when the market rebounds.

Conversely, during market euphoria, the contrarian king persona exercises caution, waiting for the frenzy to subside before selling assets at a premium.

Embracing the Unconventional: Contrarians and Strategic Investing

However, the contrarian king persona is not a reckless gambler. He values due diligence and risk management, diversifying his portfolio and employing a systematic approach for long-term success.

Though unconventional investing presents challenges, the contrarian king persona remains resolute in his convictions, trusting his instincts. He understands that being a contrarian demands conviction and resilience against short-term fluctuations for long-term gains.

In essence, the contrarian king persona demonstrates the power of investing unconventionally, uncovering unique opportunities and achieving remarkable outcomes by challenging norms. While conventional investors may find solace in conformity, the contrarian king persona recognizes that true wealth is built by venturing into uncharted market territories. Let us embrace his wisdom and cultivate the contrarian spirit on our investment journey.

Forging New Paths: The Odyssey of Tactical Investors

Avoid the “Fashion Contrarian” Trap

Contrarian investing is not a fleeting fashion but a deliberate strategy. Avoid following trends blindly and opt for true contrarian choices.

Harnessing the Contrarian Edge

Employ critical analysis to identify valuable sources of information. Combine contrarian investing with the principles of mass psychology for a deeper understanding of the markets.

Navigating Contrarian Investing: Key Considerations

Avoid popular sites for investment ideas; they often lead to losses. Be independent in your decisions, refrain from speculation, and don’t fall in love with investments.

Shattering Myths: The Fallacy of “Buy and Hold Forever”

Challenge the notion of “buy and hold forever.” Be open to opportune moments to fold and re-open positions.

Emotional Detachment: The Key to Wise Decisions

Maintain emotional detachment from investments; they are merely pieces of paper. Rationally close positions and seek greener pastures. Midst the world of investments, a distinct persona emerges known as the contrarian king persona. Unlike most investors who follow market trends, the contrarian king persona challenges the status quo. He evaluates situations critically, not swayed by emotions or herd mentality.

His key strategy involves buying when others sell and selling when others buy. In moments of panic and plunging prices, he sees opportunities to acquire undervalued assets, positioning himself for substantial gains when the market rebounds. Conversely, during market euphoria, he remains cautious, waiting for the frenzy to subside before selling at a premium.

Unique Insights: Successful Investors Embrace Contrarian Approach

In contrast to typical stock picking, the contrarian king persona follows a methodical approach without relying on experts’ opinions. He believes the most profitable investments are contrarian, buying when others sell and vice versa. This strategy shifts the risk/reward balance in his favor, but he ensures it aligns with his Strategic Asset Mix (SAM) and remains skeptical of new product offerings.

Conclusion: Embracing the Contrarian Spirit

The contrarian king persona embodies the power of investing unconventionally, challenging norms to uncover overlooked opportunities. Despite criticism, he remains steadfast, knowing true wealth is built by venturing into uncharted territories. Let us embrace the contrarian spirit and learn from his wisdom on our investment journey.

FAQs

Q1: What is a contrarian king persona in the context of investing? A: The contrarian king persona represents a unique breed of investors who challenge conventional wisdom and follow an unconventional approach to investing. They defy the crowd and critically evaluate investment opportunities, buying when others sell and selling when others buy.

Q2: What sets the contrarian king persona apart from traditional investors? A: Unlike traditional investors who rely on market trends and expert opinions, the contrarian king persona makes independent decisions based on thorough research. Emotions have no place in their strategy, as they focus on long-term gains and buy undervalued assets in times of market panic.

Q3: How does the contrarian king persona approach market euphoria? A: During market euphoria, the contrarian king persona remains cautious and waits for the frenzy to subside. He understands that inflated prices can exceed intrinsic values. Instead of following the hype, he sells at a premium and locks in profits.

Q4: What challenges does the contrarian king persona face? A: The contrarian king persona often faces criticism and skepticism from others who question their unconventional decisions. However, they remain resolute in their beliefs and trust their instincts to withstand short-term fluctuations for long-term gains.

Q5: What is the main takeaway from the contrarian king persona’s approach? A: The contrarian king persona demonstrates the power of investing unconventionally, uncovering unique opportunities and achieving remarkable results. Embracing a contrarian spirit can lead to success by challenging the status quo and venturing into uncharted market territories.

Q6: What is a contrarian king persona’s focus in investing? A: The contrarian king persona focuses on identifying turnaround opportunities in the market. They seek well-financed companies growing at a decent rate, undervalued by the market for the wrong reasons. These opportunities are often ignored or disliked by the masses.

Q7: How does a contrarian king persona make investment decisions? A: Contrarian investors do not rely on experts to make decisions. They know what they want and methodically open positions in stocks that meet their criteria. Emotions play no role in their approach.

Q8: What does “stock picking” mean, and how does it relate to the contrarian king persona’s approach? A: “Stock picking” refers to selecting individual stocks for investment. The contrarian king persona’s approach involves looking for opportunities when the masses are selling (buying) or buying (selling). This contrarian strategy aims to tip the risk/reward balance in their favor.

Q9: How does the contrarian king persona differ from typical retail investors? A: contrarian king personas avoid being manipulated by Wall Street’s exploitation tactics. They focus on well-researched, contrarian investment opportunities rather than being swayed by popular sentiments and hot stock tips.