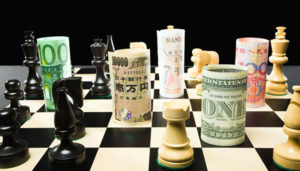

The Dow Jones Utility Average (DJUA) functions as a crucial stock market index, monitoring the performance of 15 utility companies listed on the New York Stock Exchange (NYSE). These firms provide indispensable services like electricity, gas, and water, attracting conservative investors due to their steady and predictable revenues and profits. The DJUA serves as a benchmark for evaluating utility stocks.

The Wall Street Cheat Sheet unveils a Tactical Investor theory suggesting that the DJUA can serve as a timing indicator for the broader stock market. It leads the way both upwards and downwards, empowering investors to predict changes in the overall market. A rising DJUA foretells a period of market growth, while a decline indicates an impending market downturn.

Investors can utilize the DJUA as a contrarian indicator, capitalizing on market overreactions and identifying missed opportunities. If the DJUA peaks before the broader market, it’s a signal to reduce exposure and wait for a market correction before making fresh investments.

By coupling mass psychology and technical analysis, the DJUA becomes a formidable tool for investors. Understanding groupthink psychology and avoiding herd mentality can reveal long-term growth opportunities. Technical analysis identifies market trends and support/resistance levels.

Source: tradingview.com

Dow Jones Utility Average: What Can It Reveal?

Analyzing the above chart suggests the market is heading for another corrective wave, following historical patterns. Although markets may rally till the end of March, investors must brace for significant volatility. Our past predictions have proved accurate, forecasting a market rally in 2022 that extended into 2023.

To better comprehend this phenomenon, reference the Tactical Investor Alternative Dow theory.

Random Reflections: Navigating the Next Stock Market Crash

The MOAB (Mother of All Buys) Signal: An Unprecedented Occurrence

Recently, the MOAB signal reached a remarkable score of 99, a highly uncommon event unseen in decades. A score of 93 will confirm or mark the failure of the next market move, serving as an advanced warning of a potential head fake, possibly leading to a market breakdown.

Anticipate a rapid market decline, varying from moderate to severe, with a swift recovery expected. Instead of dwelling solely on the correction’s severity, focus on potential arising opportunities.

Market Activity and Bullish Bias

Over the past three weeks, the S&P 500 has shown minimal activity, with a net gain of less than 10 points by Sunday. While the market isn’t currently breaking out or breaking down, the bullish bias, persisting since the bottom established around July last year, suggests an eventual upside breakout.

Sentiment as an Uncertainty Gauge and a Long-Term Bullish Outlook

Sentiment has remained within an unprecedented significant trading range for 18 months, with bullish sentiment consistently trading below historical averages. This broad gauge of uncertainty hints at a long-term bullish outlook, implying the bull market may endure longer than anticipated, potentially exceeding the 2009 crash’s duration.

Market Behavior and the Expectations of Bears and Bulls

Typically, a strong rally followed by wide-ranging market trades entails a sharp pullback before a more robust rally. However, the current situation presents a notable deviation. The bears anticipate a strong pullback, while the bulls foresee a robust rally.

The best strategy is to mislead both groups, creating the illusion of a market breakout to new highs, followed by a sharp drop and an impression of a sell-off. However, the sell-off lacks traction, resulting in a medium sell-off, catching both groups by surprise. The projected roadmap outlines the expected market path until March 2024, incorporating support and resistance lines surpassing previous expectations.

Strategic Roadmap and Market Movements

Applying this roadmap suggests the SPX may reach new highs in 2023, surpassing 4200 and reaching the 4250 to 4300 range. Subsequently, expect a sharp reversal and drop to the 3600 to 3900 range, possibly with a low probability overshoot to 3450. This will be followed by a sharp upward reversal, a less sharp pullback, and the SPX gradually ascending to the 4400 to 4700 range.

Strong bullish signals will emerge during the aforementioned market actions, irrespective of their intensity.

Q: What is the Wall Street Cheat Sheet – Psychology of a Market Cycle? A: The Wall Street Cheat Sheet – Psychology of a Market Cycle refers to a comprehensive analysis of investor behavior and market trends to understand the dynamics of market cycles.

Q: How does the Dow Jones Utility Average (DJUA) function as a Timing Indicator for the Stock Market? A: The DJUA tracks the performance of 15 utility companies on the NYSE, which offer essential services. Its movements can predict changes in the overall market, indicating potential periods of growth or decline.

Q: Why are Utility Companies attractive to conservative investors? A: Utility companies have stable and predictable revenues, making them attractive to conservative investors seeking steady returns.

Q: How can investors use the DJUA as a Contrarian Indicator? A: Investors can exploit market overreactions by using the DJUA to identify opportunities that others might have missed. Peaks in the DJUA before the broader market can signal the need to reduce exposure and wait for corrections before making new investments.

Q: What is the Tactical Investor Alternative Dow theory? A: The Tactical Investor Alternative Dow theory is a unique approach to understanding market dynamics and making investment decisions based on a combination of market indicators and behavioral psychology.

Q: How can Mass Psychology and Technical Analysis be combined with the DJUA for better investments? A: Understanding groupthink psychology and avoiding herd mentality can help investors identify long-term growth opportunities. Technical analysis assists in identifying market trends and support/resistance levels.

Q: What does the MOAB Signal signify in the stock market context? A: The MOAB (Mother of All Buys) Signal is a significant indicator. A high score of 99 suggests an unprecedented occurrence, possibly leading to a market breakdown, indicating a rapid market decline followed by a swift recovery.

Q: Can market sentiment be used as a gauge for investment decisions? A: Yes, market sentiment can provide valuable insights into market uncertainty and investors’ outlook. It can influence long-term bullish or bearish trends.

Q: How can investors navigate market volatility and corrections effectively? A: Investors can navigate market volatility by staying informed about market indicators, conducting thorough analysis, and focusing on long-term investment opportunities.

Q: What are the expected market movements according to the Strategic Roadmap? A: The Strategic Roadmap suggests potential market highs in 2023, followed by sharp reversals and gradual upward momentum, with strong bullish signals emerging during market actions.